california sales tax payment plan

The payment plans are in addition to the previous assistance CDTFA has rolled out to small businesses for any taxes and fees administered by CDTFA. See if you Qualify for IRS Fresh Start Request Online.

Surplus In Hand California Governor Proposes Tax Cuts Expanded Health Care Cbs8 Com

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

. District Taxes Sales and Use Taxes PDF Drug Stores PDF Grocery Stores PDF Jewelry Stores PDF Interior Designers and Decorators PDF Liquor Stores. There is a statewide county tax of 125 and therefore the lowest rate anywhere in California is 725. Keep enough money in.

Not only is this the highest base rate in the country but some counties and cities charge even higher rates. However your total penalty will not exceed 10 percent of the amount of tax for the reporting period. Pay by automatic withdrawal from my bank account.

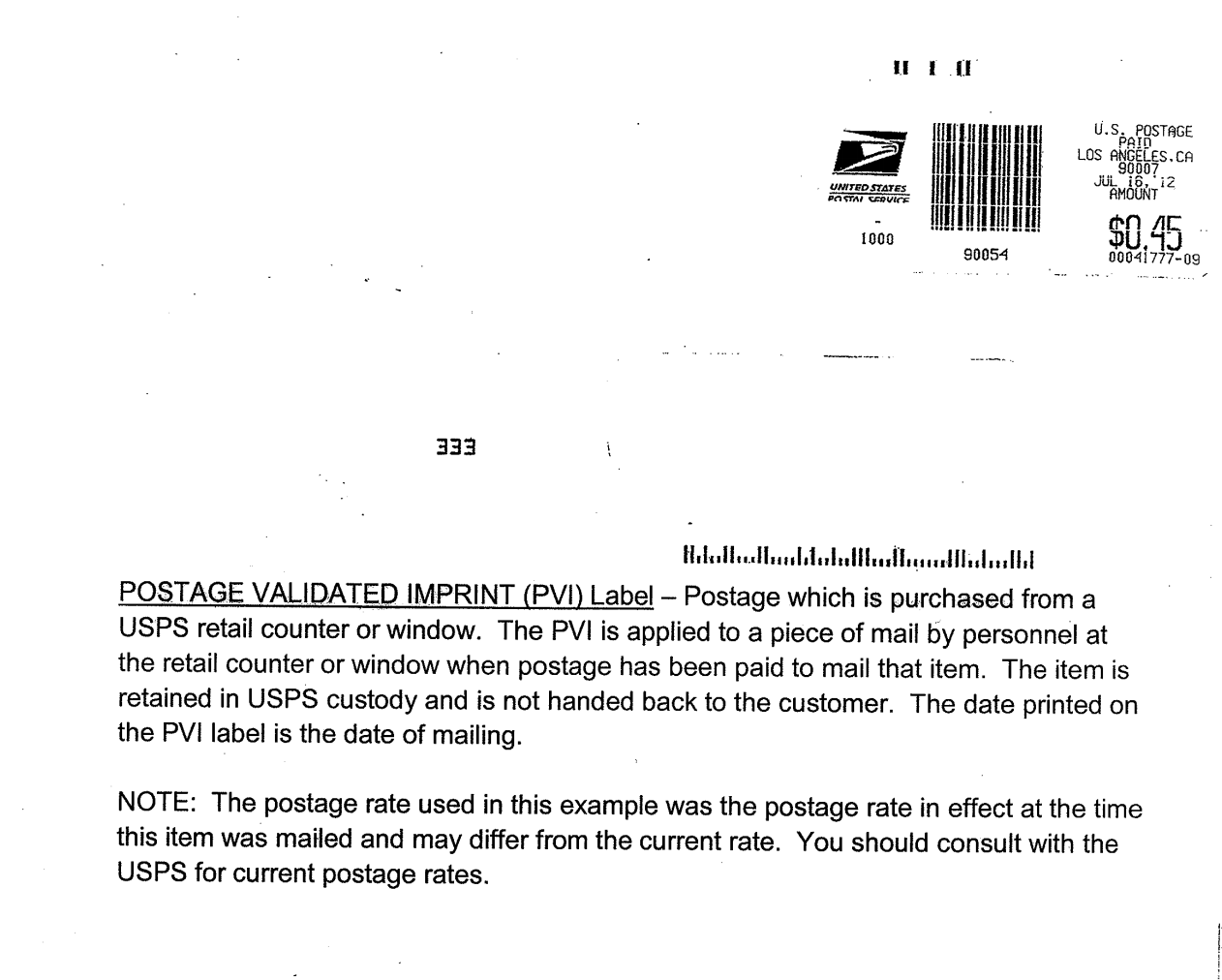

Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax in California. Effective December 15 2020 small business taxpayers with less than 5 million in taxable annual sales can take advantage of a 12-month interest-free payment plan for up to 50000 of sales. Pay a 34 setup fee that will be added to my balance due.

You may be required to pay electronically. An additional 10 percent penalty may apply if you do not pay the tax by the. The State of California has provided access to payment plans.

Simplified income payroll sales and use tax information for you and your business. For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12. Make monthly payments until my tax bill is paid in full.

Electronic funds withdrawal EFW. Bank account - Web Pay Free Credit card service fee Payment plan setup fee Check or money order. Effective April 2 2020 small businesses with less than 5 million in taxable annual sales can take advantage of an interest- and penalty-free sales tax payment plan being offered.

See if you Qualify for IRS Fresh Start Request Online. BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales taxes that they have collected from customers. Complete Edit or Print Tax Forms Instantly.

Individual taxpayers who owe up to 25000 to the California FTB Franchise Tax Board can pay in. Ad Fast Secure - Florida State Sales Use Tax Application - Ca Taxes California Tax. The California sales tax is a minimum of 725.

Save time and increase accuracy over manual or disparate tax compliance systems. A sellers permit is issued to business owners and allows them to. It may take up to 60 days to process your request.

Pay including payment options collections withholding and if you cant pay. Ad Complete Tax Forms Online or Print Official Tax Documents. Electronic funds transfer EFT for corporations.

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. 7250 Note that the true California state sales tax rate is 6. Ad Owe back tax 10K-200K.

Ad Owe back tax 10K-200K. Provide an automatic three-month payment extension for taxpayers filing less than 1 million in sales tax on their returns and extend the availability of existing interest and. Ca Taxes California Tax registration application for new businesses.

California taxpayers can easily qualify for a payment plan if they owe less than 25000 and can repay the total including interest and penalties within 60 months.

Secured Property Taxes Treasurer Tax Collector

California Health Care Coverage Notification

What You Need To Know About California Sales Tax Smartasset

State Accepts Payment Plan In Santa Cruz Ca 20 20 Tax Resolution

21 Billion Budget Surplus More Than 2 Billion In New Taxes

How To File And Pay Sales Tax In California Taxvalet

Food And Sales Tax 2020 In California Heather

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

How To Calculate California Sales Tax 11 Steps With Pictures

Faulconer Proposes Largest Middle Class Tax Cut In California History

Gov Newsom Unveils Tax Relief Cash Grants For Small Businesses

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

Treasurer And Tax Collector Los Angeles County

How To Calculate California Sales Tax 11 Steps With Pictures

What You Need To Know About California Sales Tax Smartasset

Understanding California S Sales Tax

California Announces Sales Tax Payment Plan For Small Businesses

California Sales Tax Small Business Guide Truic

Ca Homeowners Here S How The Gop Tax Plan Might Affect You Kpcc Npr News For Southern California 89 3 Fm